We'll show you how.ĭownload it today, FREE when you sign up for our complimentary Cabot Wealth Daily advisory!

This free report aims to give you the confidence - and the right know-how - to dive right into the stock market. And unless you majored in finance or are a stock broker yourself, you may not feel confident enough to start investing on your own. The current stock market is creating huge opportunities to invest - even during a pandemic. However, all was forgiven, and hedge funds have since rebounded, and now hold an estimated $4 trillion.

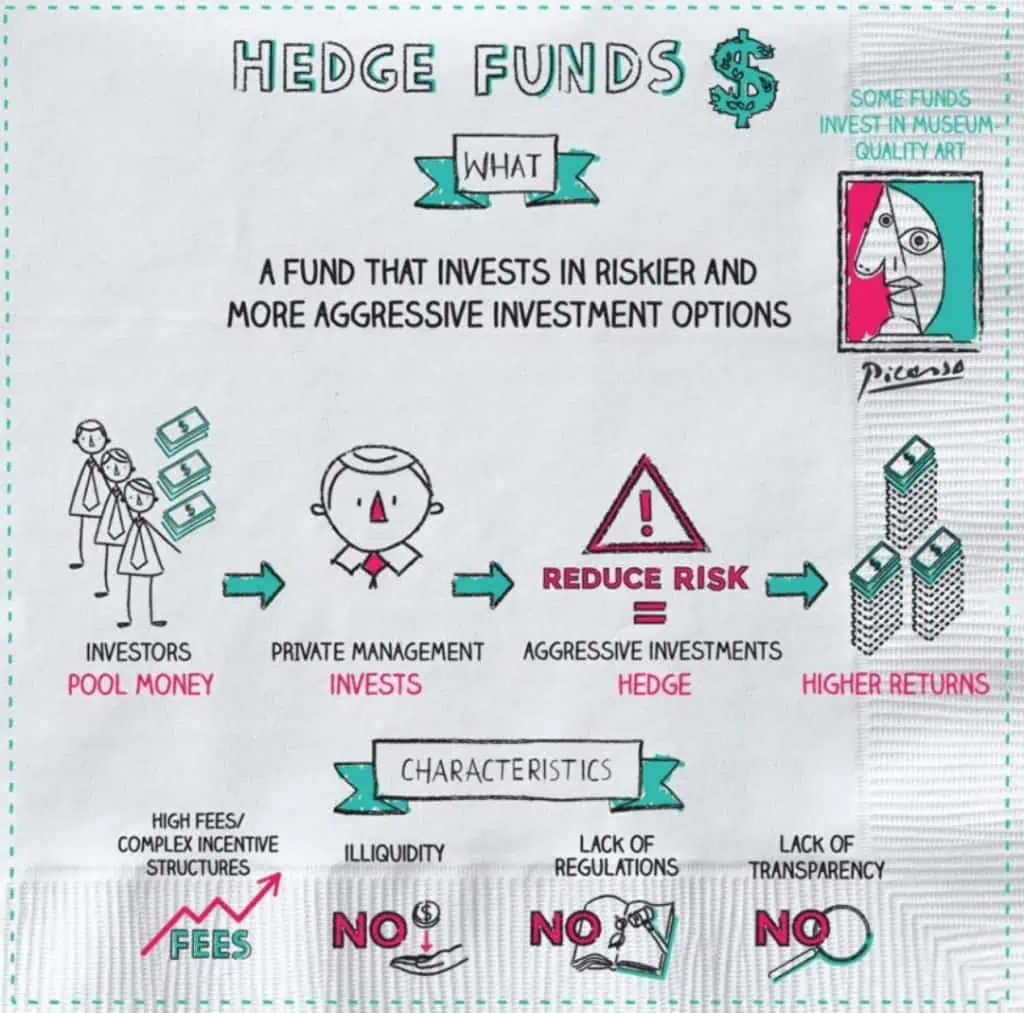

They suffered a setback during the hard times, as many of them began limiting investor withdrawals. Hedge funds became very popular in the 1990s and grew rapidly, gathering assets of more than $1.93 trillion by the time the 2007-2009 recession hit. And, as you might imagine, they are primarily headquartered in the well-heeled enclaves of New York, Chicago, San Francisco, Dallas, Greenwich, and Boston. Catering to “qualified” investors-those with $1 million or more to hand over-there are now some 2,700 such funds, according to the United States Hedge Fund List. Today, the hedge fund concept is alive and well. It is speculated that the skills he picked up in his previous careers working on a steamship, and as a diplomat, sociologist, and journalist served him well as a hedge fund manager. In his fifth career-as an investment manager-Alfred Winslow Jones contributed $100,000 to create the first hedge fund for wealthy investors in 1949.

0 kommentar(er)

0 kommentar(er)